Financial Inclusion and Financial Health in Migration Contexts

Anastasia Thano and Kim Wilson

Kim Wilson is a Sr. Lecturer and Sr. Fellow at The Fletcher School at Tufts University. She is the Principal Investigator of the Journeys Project.

Anastasia Thano is a master’s candidate at The Fletcher School.

In contexts of populations migrating or settling, financial inclusion means that refugee and migrant customers have the tools they need to manage their financial tasks.

Financial health looks beyond the management of financial tasks to mea- sure four key indicators that collectively describe the financial wellbeing of a person, household or business.

Financial Inclusion

Financial inclusion refers to the financial sector of a given country or region effectively reaching all populations in a jurisdiction with a suite of financial services. Those services may include banking services, remittance services, as well as insurance and credit or payment services. Particularly relevant in refugee economies are humanitarian cash payments which can flow from a charity or government into financial accounts of refugees and migrants.

In a migration setting, refugees and migrants face similar financial issues as host populations with a few additional barriers. Often, they do not have permission to work or open a business and thus are prevented from earning an income. Without an income, they have less need for financial services. They may need reliable remittance or cash transfer services, but likely not credit services that depend on a steady wage to make loan repayments or savings services when there is little to save.

Our research shows that while financial inclusion can be important in some settings, it may be irrelevant in others. For example, in northern Mexico, migrant workers may need to open a bank account to receive factory wages. But, in Jordan, where work permits for refugees are few and far between, banking and mobile money services are not necessary. There is no income to store savings or to pay back a loan.

Financial Health

We have found that a more useful set of indicators goes beyond access to financial services and investigate indicators that demonstrate financial health. A financially healthy household or business is one that can cover its basic day-to-day needs; recover from a financial setback (medical emergency or job loss of a household member); comfortably manage its debt; and take advantage of opportunities which could be economic or educational.

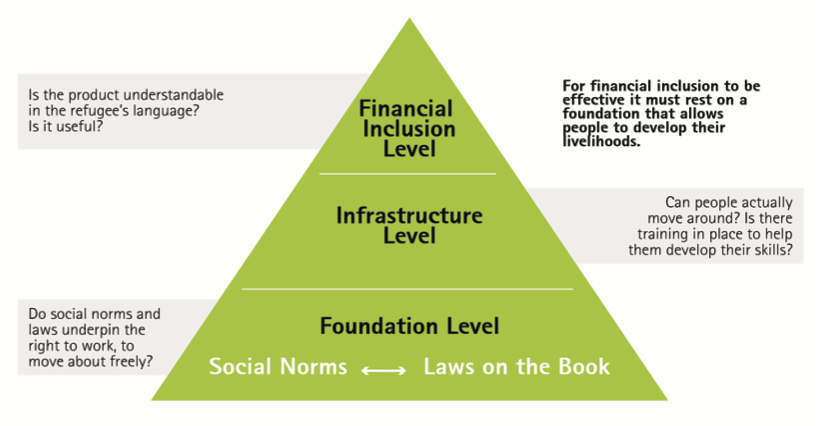

Our research shows that in refugee economies, financial health is hard to come by even when financial services are available. Without ways to make a living, refugees and migrants do not need financial services, they need work. The biggest contributors to financial health are not financial services but important foundational rights such as the right to work; to move around; to be protected. Once migrants and refugees can avail themselves of these rights, the need for financial services begins to evolve. Earnings can generate household surpluses which can be put into a savings account; earnings can help pay back loans or purchase insurance.

In sum, the essential elements for a financially healthy person in displacement are:

- Being able to meet basic needs. Can the household cover is daily costs of food, medicine, rent, and so on?

- Being able to recover from a financial setback. Can the household regain its footing if a member of the household falls ill or loses a job?

- Being able to comfortably manage their debt. Can the household pay off its loans without being unduly burdened?

- Being able to invest in opportunities. Can the household access credit or savings to invest in its economic future, whether by pursuing educational ambitions, buying a home, or investing in a business?

In the Finance in Displacement: Joint Lessons Report, Kim Wilson (Tufts University) and Hans-Martin Zademach (KU Eichstätt-Ingolstadt) conclude that financial inclusion and access to services alone do not lead to fulsome livelihoods or financial health. Rather, fulsome livelihoods and improved financial health led to the need for more financial services. The report highlights several examples of migrants across Mexico, Kenya, Jordan, and Uganda facing multiple challenges related to economic integration.

The discussion surrounding financial inclusion so far has advocated for the increase in accessibility of financial services. However, the example in this summary supports that access to financial services alone does not lead to fulsome livelihoods for vulnerable groups. Financial inclusion alone can- not guarantee financial health, unless the access to financial services is coupled with policies that support the creation of additional labor market sectors that employ vulnerable groups and improve bureaucratic processes that ensure these groups can economically integrate (i.e., work permits, business and driving licenses, easing of business registration processes, and more).

Thano, Anastasia and Kim Wilson. Leir Briefing Room: Financial Inclusion and Financial Health in Migration Contexts. Medford: leir Institute for Migration and Human Security, 2023. https://leir-briefing-room.ghost. io/financial-health/.

Recommended Reading

Dhawan, S. M., Wilson, K., & Zademach, H.-M. (2022). Formal Micro-Credit for Refugees: New Evi- dence and Thoughts on an Elusive Path to Self-Reliance. Sustainability, 14(17), 10469. https://doi.org/10.3390/su141710469

Dhawan, S.M., Wilson, K., Zademach, H.-M., & Zollmann, J. (2023). No financial inclusion without basic economic rights. Forced Migration Review, 71, 25-28.

Rhyne, E. & Gubbins, P. (2021). Financial Health: An Introduction for Financial Sector Policymakers. UNSGSA Financial Health Working Group. https://www.unsgsa.org/sites/default/files/resourc- es-files/2021-09/UNSGSA%20Financial-health-introduction-for-policymakers.pdf

Databases and Other Resources

The Global Findex Database. World Bank. https://globalfindex.worldbank.org/

G20 Financial Inclusion Indicators. Global Partnership for Financial Inclusion (GPFI). https://www.gpfi.org/data

The Journeys Project. Henry J. Leir Institute for Migration and Human Security at Fletcher. https://sites.tufts.edu/journeysproject/

National Financial Well-Being Survey Data. U.S. Consumer Financial Protection Bureau. https://www.consumerfinance.gov/data-research/financial-well-being-survey-data/